are funeral expenses tax deductible in ireland

In arriving at the taxable value of the estate the following. In short these expenses are not eligible to be claimed on a 1040 tax.

Is The Medicare Premium Taxable Rules Income Limits And More

ALL YOUR PAPER NEEDS COVERED 247.

. It is important to note that where the taxable value exceeds the relevant threshold the entire estate is liable to tax. While the IRS allows deductions for medical expenses funeral costs are not included. While the IRS allows deductions for medical expenses funeral costs are not included.

If you spend money on something that is for both business and private use you can claim a deduction for part of the expense. When Can Funeral Costs Be Tax-Deductible. In order for funeral expenses to be deductible you would need to have paid.

There are a few exceptions though. As we mentioned funeral expenses arent tax-deductible for most individuals. This is 3400 in 2022.

Only the estate of the. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses. Do Funeral Expenses count as medical expenses.

If the estate in question pays federal taxes they may be able to deduct the funeral expenses on a return if the estates funds were used for the funeral costs. This could affect whether or not youre able to deduct the cost. In general arms-length expenses that are incurred wholly and exclusively for the purposes of the trade are tax-deductible.

Its natural to wonderis there a way I can get a discount on this. As with all tax rules. Capital items expensed to a companys profit and.

Funeral and burial expenses are only tax deductible if theyre paid for by the estate of the deceased person. Although funeral expenses are non-deductible for living individual taxpayers estates can claim these costs when the executor is preparing final tax returns. Individual taxpayers cannot deduct funeral expenses on their tax return.

If the funeral was paid for with. Individual taxpayers cannot deduct funeral expenses on their tax return. An individual who pays funeral expenses does not receive tax deductions.

For estates with a gross value of at least 1158 million tax-deductibility relies on how the funeral was paid for. Funeral Cover Credit Life Cover. The ability to deduct funeral expenses on your tax returns depends on who paid for the funeral expenses.

Feb 21 2019 Any. This means you will have to give information about how much income you have including savings and insurance policies that the deceased family. Individuals cannot claim funeral and burial expenses on their individual.

According to the IRS funeral and burial expenses are only deductible if paid out by the decedents estate. This would include items such as phone bills motor. Funeral expenses that are NOT tax-deductible are any which are not paid by the deceased persons estate.

The short answer to this is no -- funeral expenses are not tax-deductible in the vast majority of cases. Unfortunately funeral expenses are not tax-deductible for individual taxpayers. However end-of-life expenses are tax-deductible if they exceed 75 of the persons adjusted.

You will still get the Married Person or Civil Partners Tax Credit in the year of death. Knowing if your funeral expenses count as a medical expense is essential. The deductible amount is up to JPY88000 for portion exceeding JPY12000 for.

Unfortunately funeral expenses are not tax-deductible for individual. In other words if you die and your heirs pay for the funeral. Burial and funeral expenses can really add up especially when you arent prepared for them.

Any family members out-of-pocket expenses for your funeral will not receive tax deductions. In the years following the year of death you will get the Widowed Person or Surviving. Stamp duty legal costs.

Most individuals dont qualify for tax deductions on the funeral expenses of a close relative although some estates may make them eligible. This payment is means tested.

Funeral Expenses Tax Deductible Ireland Best Reviews

How Do I Pay The Funeral Director And Funeral Related Expenses Bank Of Ireland

How To Reduce Inheritance Tax In Spain

Every Single Thing You Should Be Claiming Tax Back On In Ireland That Could Pocket You Thousands Irish Mirror Online

Simple Paye Taxes Guide Tax Refund Ireland

Expenses You Can Claim If You Re Self Employed In Ireland

Are Funeral Expenses Tax Deductible Claims Write Offs Etc

Accounting For Funeral Costs Contributions To Funeral Costs Rand Download Table

Social Security Scotland Bill Policy Paper Funeral Expense Assistance Illustrative Regulations And Policy Narrative Gov Scot

Chapter 15 Transfer Business Tax Pdf Tax Deduction Estate Tax In The United States

Social Security Scotland Bill Policy Paper Funeral Expense Assistance Illustrative Regulations And Policy Narrative Gov Scot

1st Tax Review Questionnaires With Answers Pdf Value Added Tax Taxes

Social Security Scotland Bill Policy Paper Funeral Expense Assistance Illustrative Regulations And Policy Narrative Gov Scot

Top Organizations That Help With Funeral Expenses

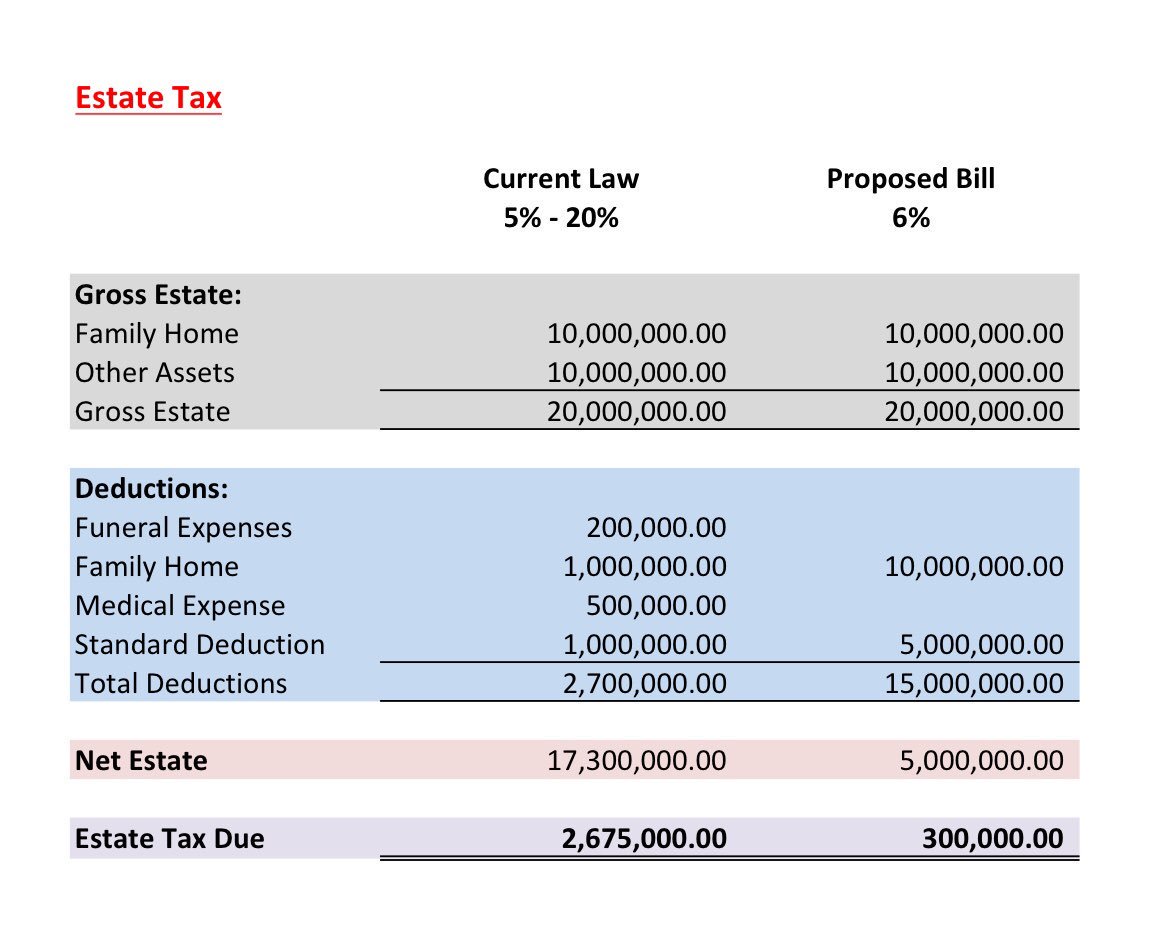

Here S Another Illustration On Estate Tax For Example A Loved One Dies And Leaves You With P20 M In Assets This A Compar Abs Cbn News Scoopnest

Accounting For Funeral Costs Fraction Mean Download Table

Module 6 Accounting For Tax Ruth Ni Dhonduin Ppt Download

5 Tax Deductible Expenses For Executors Fifth Third Bank

What Is The Effect Of Death On State Benefits And Credits Low Incomes Tax Reform Group